cash float meaning|additional float credit card meaning : iloilo Float is money within the banking system that is briefly counted twice due to time gaps in registering a deposit or withdrawal. Learn how to calculate float, how it works, and how it can be used to . The restrictions on video sharing sites like LiveLeak are minimal. 13. 9GAG TV. This video sharing platform enables users to upload pictures, GIFs, and videos. The Hong Kong-based social media site also allows users to upload videos from other .

PH0 · what is petty cash float

PH1 · what is a till float

PH2 · float money meaning

PH3 · definition of float in banking

PH4 · cash float sheet

PH5 · cash float meaning in accounting

PH6 · additional float credit card meaning

PH7 · a float in cash flow

PH8 · Iba pa

Glitter Urdu Meaning - Find the correct meaning of Glitter in Urdu, it is important to understand the word properly when we translate it from English to Urdu. There are always several meanings of each word in Urdu, the correct meaning of Glitter in Urdu is روشن ہونا, and in roman we write it Roshan Hona.

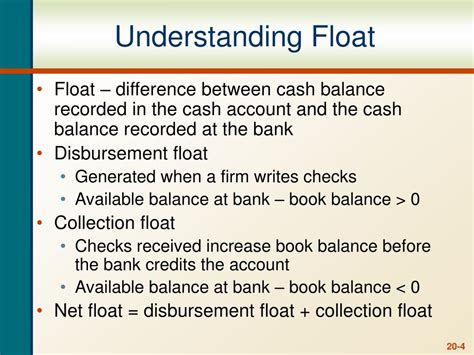

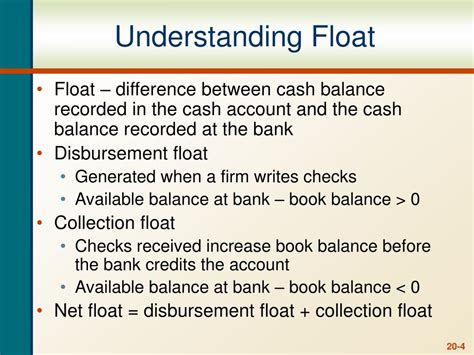

cash float meaning*******Cash float is difference between the cash balances reported in your business accounting and the amount of cash you actually hold in your bank accounts. This discrepancy is usually the result of delays in payments or money transfers, as well as processing checks, which may take a bank . Tingnan ang higit pa

Although cash float exists in both of these circumstances, it’s less of an issue in retail and restaurant settings. The cash should come back within the . Tingnan ang higit pa

Knowing that cash float will exist in your business means you have the opportunity to identify systems internally to prevent confusion and error. Without a . Tingnan ang higit pa

Accounting discrepancies are every business owner’s nightmare. But, cash float is a normal part of any healthy business’s financial lifecycle. Just be sure . Tingnan ang higit pa

Float is money within the banking system that is briefly counted twice due to time gaps in registering a deposit or withdrawal. Learn how to calculate float, how it works, and how it can be used to . Learn what cash float means in finance and banking, and how it relates to collection float, disbursement float, and net float. See examples of how cash float affects transactions and accounts. This refers to the amount of cash placed in registers at the beginning of a shift or workday. The cash float typically consists of a nominal amount of money, such .

Learn what cash float means in two different contexts: the cash in the cash drawer and the difference between accounting and bank balances. Find out how to .cash float meaning additional float credit card meaningCash float is the time delay between the movement of funds from one account to another, or a small amount of cash kept on hand by a company. Learn how cash .Cash float refers to the discrepancy between the cash balances reported in a business's accounting records and the amount of cash the business actually has available in . Cash Float Defined. In general, cash float refers to the difference between the cash balance recorded in your accounting system's cash account and the . Another key part of cash management is called cash float. Cash float is the amount of time that cash is floating between two companies. What does floating .Float is the term used to represent duplicate money present between the time a deposit is made and when the deposit clears the bank. Learning Objective. Discuss how to .The definition of a cash float in accounting is slightly different because it refers more to petty cash used for day-to-day expenses. This cash is kept on the premises or in a designated petty cash account for employees to use. From a one day float bank account to automated payment software, there are numerous ways to track and reduce the time . Average Daily Float: 1. The dollar amount of checks or other negotiable instruments that are in the process of collection over a certain period, divided by the number of days in the period; or 2 .

To speed up your collection float, you must compress the time between receiving cash and checks and depositing them in the bank. To do this, you can designate a post office box for all invoice . Store the cash float funds in a safe and secure place; for example, in a safe, a locked drawer or a metal box. Announce the establishment of the cash float to anyone who might need to use the funds. If anybody wants to use the cash float money, he must get the approval of the custodian. When the level of funds falls below the level you .additional float credit card meaning Our float has grown from $16 million in 1967, when we entered the business, to $62 billion at the end of 2009. Moreover, we have now operated at an underwriting profit for seven consecutive years .In economics, float is duplicate money present in the banking system during the time between a deposit being made in the recipient's account and the money being deducted from the sender's account. It can be used as investable asset, but makes up the smallest part of the money supply.Float affects the amount of currency available to trade and .

Float is a financial term that refers to the time when a sum of money exists in multiple places simultaneously. Float occurs when an entity uses a check for payment, as the receiver considers the money in their possession though it hasn't been withdrawn from the payer's account. If you're interested in financial literacy, you may want to learn .About Hoteltutor. Hoteltutor is an site devoted to providing training to hotel employees, usually in form of short lessons and indepth courses. We cover training for all departments in hotel. Enroll in a Membership.

Cash float can be utilized to avoid late fees, earn interest, and manage cash flow. Net float can be a positive or a negative number. Read Cash Float Definition, Types & Examples Lesson.cash float meaningCash float can be utilized to avoid late fees, earn interest, and manage cash flow. Net float can be a positive or a negative number. Read Cash Float Definition, Types & Examples Lesson.

Petty cash is a small fund of cash kept on hand maintained by a custodian for purchases or reimbursements too small to be worth submitting to the more rigorous purchase and reimbursement . Optimizing Cash Float Management in POS Systems. Define cash float guidelines. Ensure secure storage. Appoint a trusted custodian. Regular audits and reconciliation. Maintain record keeping. Communicate cash float procedure. Plan for cash float adjustments. Best Practices for Cash Float Management with a POS System.Float In Relation To Cash Management. Floating Cash In cash management, float can be utilized to make use of cash on hand for as long as possible. When managing cash disbursements, a company should endeavor to increase the amount of time present in the disbursement cycle. In other words, it is appropriate to delay making payments until they . Calculate the Denominations You Will Need. Figure out what denominations of bills and coins you will need, and how many of each you will need to carry you through. For a $150 cash float breakdown where your primary cash sale total is $4.50, you will need to ensure you have many quarters and $5 bills, because your customers may hand you a .

Cash float refers to the discrepancy between the cash balances reported in a business's accounting records and the amount of cash the business actually has available in its bank accounts. Properly managing cash float is crucial for companies to ensure smooth operations, maintain proper cash flow, and have access to readily available funds when .

Cash float is the amount of change in the cash drawer at the beginning of a business day. The cash is broken down into different denominations, enabling a cashier to give change to customers.Definition of Float. In accounting and bookkeeping, float is the time between the writing of a check and the time that the check clears the bank account on which it is drawn.. Examples of Float. Payer Corporation writes a check for $5,000 and mails it to a supplier on Wednesday. However, the check will not clear Payer Corporation’s checking account .In fact the availability float is the time gap between the deposit of a check and the availability of the funds on the firm’s account. It depends on the conditions agreed upon by the bank and its customer, in our case the receiving party, known as “valuta” days. It ranges from same day up to two or three business days, depending on the . The buyer wants the cash float to be as slow as possible because the longer it takes for the check to get to the selling company and then be deposited, the longer the funds stay in our bank account. The seller wants the cash flow to be quick as possible because the selling company wants to receive its money from its sales. There are two .

Passo a Passo para Você se cadastrar no site adBTC e começar a Ganhar seus Bitcoins Grátis. LINK DO SITE adBTC: https://ref.adbtc.top/616155BITCOIN: Sites e .

cash float meaning|additional float credit card meaning